Commenting on the key financial highlights of the year and fourth quarter, Sappi Chief Executive Officer Steve Binnie said: "I am very satisfied with the strong performance by the group during the financial year. Importantly, net profit for the year increased by 24% to US$167 million and earnings per share excluding special items for the year increased by 55% from US 22 cents to US 34 cents.

Operating performances improved in all regions in their underlying currencies. In particular, the group benefitted from the strong export performance of the Southern African business combined with a weaker South African Rand. In Rand terms group EBITDA excluding special items increased by approximately 8% from ZAR7 billion to ZAR7.5 billion and group net profit increased by 40% from ZAR1.4 billion to ZAR2 billion on group sales of ZAR64.5 billion for the year.

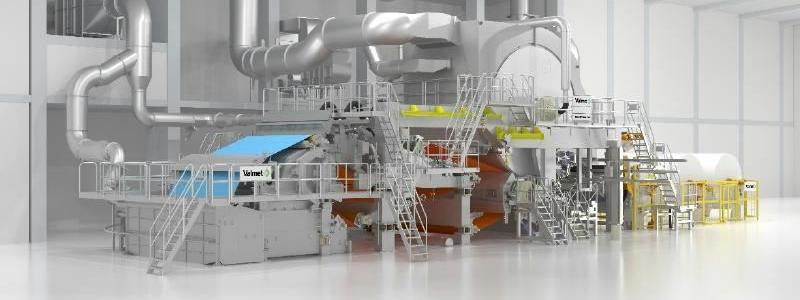

"The refinancing of higher cost debt, and the reduction in net debt by US$175 million resulted in significantly lower ongoing interest charges. The completion of major capital projects at Gratkorn, Kirkniemi and Somerset Mills will lower our cost base further in the coming years.

"For the quarter, all regions increased their profitability through stronger seasonal demand and improved markets for graphic paper and dissolving wood pulp. For the quarter, profit increased by 22% to US$83 million due to the higher operating profits and lower interest costs.

"The Specialised Cellulose business generated improved returns due to increased US Dollar spot prices for dissolving wood pulp in China; driven by improved conditions for viscose staple fibre. The weaker Rand also helped margins, lowering our cost base and improving selling prices."

The European business achieved an increase in graphic paper sales volumes of 5% and average sales prices of 4% over the equivalent quarter last year, with particular strength in the woodfree coated segment. This was mainly due to the Euro/Dollar exchange rate on export sales pricing and the graphic paper price increases implemented in the past quarter. The speciality paper business continued to improve its sales volumes and prices compared to both the prior quarter and the equivalent quarter last year.

The North American business showed a good recovery in a seasonally stronger quarter. This is despite the continued impact of the strong US Dollar on the graphic paper markets in the US and continued weak demand from China for the release paper business. Coated paper sales volumes were flat year-on-year, with net sales prices slightly lower.