Global fluff pulp consumption in 2017 is 5.8 million air-dried and has value of $4.6 billion according to the latest exclusive research from Smithers Pira.

Smithers’ in-depth market analysis shows how this demand will increase by 3.7% per year to reach 7.0 million air-dried tonnes in 2022. Value growth will be slower, and yield a market value of $5.3 billion by the end of the study period, with a series of emergent opportunities for fluff pulp suppliers and users fueling worldwide expansion.

Historically, the hygiene segment - diapers/nappies, feminine hygiene pads, and adult incontinence products – has consumed the majority of the fluff pulp globally, and driven overall growth 2012, hygiene end uses accounted for 90.3% of world fluff consumption By 2022, though, these end uses will consume only 89.5% of the world fluff pulp; a small drop in market share, but an indicator of longer-term trends that have been place for Several years.

Volume growth in hygiene will follow the market average, but the fastest expanding end-use application will be nonwovens, where consumption for the next 5 years is forecast to increase at 5.5% per year.

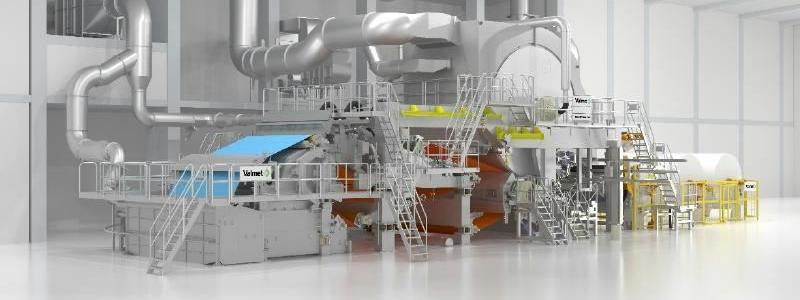

‘These new markets will evolve alongside developments in the supply of fluff pulp’. Phil Mango, author of the Smithers report, says: ‘The trend in fluff pulp production is expansion in South America and North America, while Europe has concentrated on modifying pure fluff-producing mills to biorefineries. A biorefinery uses biomass as the input, and produces a wide variety of products and energy. In the fluff pulp biorefinery, wood is input and chemicals, pulp, and even energy are produced. This is not only more sustainable as a process, but improves the profitability of the mill, especially one with marginal profitability.’

Geographically, the fluff pulp is relatively mature in North America and Western Europe, meaning these regions will have the lowest growth rates for fluff pulp. While Asia, South America, and Eastern Europe will increase relative market share.

The competitive landscape for fluff pulp is dominated by large pulp and paper companies headquartered in North America. This is due mainly to the presence of the most optimal wood species for fluff pulp in North America. The three largest fluff pulp producers are International Paper, Georgia-Pacific, and Domtar. These three producers account for about 4.9 million air dried tonnes, or 80% of all fluff pulp production in 2017.

The short growing seasons in northern Europe and Asia, and sub-optimal soil and climate conditions in most of southern Asia, have reduced the potential of these regions. Infrastructure issues in South America and Russia continue to retard progress in these regions.