Packaging Corporation of America recently reported second quarter 2016 net income of $116 million, or $1.23 per share and $1.25 per share excluding special items. Second quarter net sales were $1.42 billion in 2016 and $1.45 billion in 2015.

The $.07 per share increase in second quarter 2016 earnings, compared to the second quarter of 2015, was driven primarily by higher corrugated products volumes ($.04), lower costs for energy ($.06), fiber ($.05), freight ($.04) and a lower share count resulting from share repurchases ($.04). These items were partially offset by lower domestic containerboard and corrugated products prices and mix ($.04), lower containerboard export prices ($.03), lower containerboard domestic and export volume ($.04), lower pulp volume ($.02), lower white paper and pulp prices and mix ($.01), and higher depreciation and other fixed costs ($.02).

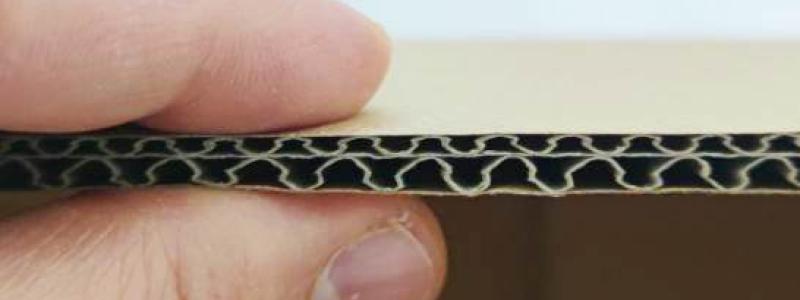

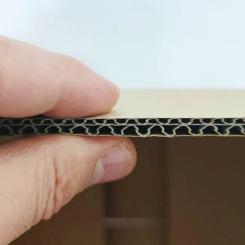

Corrugated products shipments were up 2.2% in total and up 0.6% per workday compared to the second quarter of 2015. Packaging segment price and mix was lower than the second quarter of 2015, but up compared to the first quarter of 2016. Containerboard production was 926,000 tons, and containerboard inventory was flat compared to the end of the first quarter of 2016 and the end of the second quarter of 2015.

Paper segment price and mix was lower than the second quarter of 2015, but higher than the first quarter of 2016. White paper sales volume was up slightly and pulp volume was lower compared to the second quarter of 2015, while volume for both white paper and pulp was lower than the first quarter of 2016 primarily due to scheduled annual outages at two mills.

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “We achieved record second quarter earnings despite lower pricing in packaging and paper products. Our corrugated products volume for the quarter set all-time records for both total shipments as well as shipments per day, and corrugated prices and mix were up compared to first quarter 2016 levels. White paper prices and mix showed positive trends towards the end of the quarter as a result of the previously announced price increases. Operationally, we had another exceptional quarter as manufacturing and freight costs across our packaging and paper mills were outstanding and we successfully completed four annual outages.”

“Looking ahead to the third quarter,” Mr. Kowlzan added, “we expect higher containerboard, corrugated products and white paper shipments. Paper prices should move higher reflecting continued realization of the announced price increases, and our annual outage costs will be lower. We expect a less rich mix in corrugated products and higher prices for recycled fiber, electricity and fuels. Considering these items, we expect third quarter earnings of $1.30 per share. Finally, as previously announced, we are on track to close the acquisition of TimBar later in the third quarter.”

We provide information regarding our use of non-GAAP financial measures and reconciliations of historical non-GAAP financial measures presented in this press release to the most comparable measure reported in accordance with GAAP in the schedules to this press release. We present our earnings expectation for the upcoming quarter excluding special items as special items are difficult to predict and quantify and may reflect the effect of future events. We currently expect special items in the third quarter to include fees, expenses and purchase accounting charges relating to the TimBar acquisition. Additional special items may arise due to third quarter events.

PCA is the fourth largest producer of containerboard and corrugated packaging products in the United States and the third largest producer of uncoated freesheet paper in North America. PCA operates eight mills and 90 corrugated products plants and related facilities.