Smithers Pira publishes a new report entitled, The Future of Tissue Manufacturing to 2021, which provides an in-depth, long-term assessment of the rapidly evolving tissue manufacturing processes.

Operating environment trends and diverging product performance levels will push alternative manufacturing technologies. Tissue manufacturers occupying economy segments compete primarily on price. This requires increased focus on productivity and cost control. Premium level product performance will drive increased adoption of structured sheet technologies supported by chemicals and fibres.

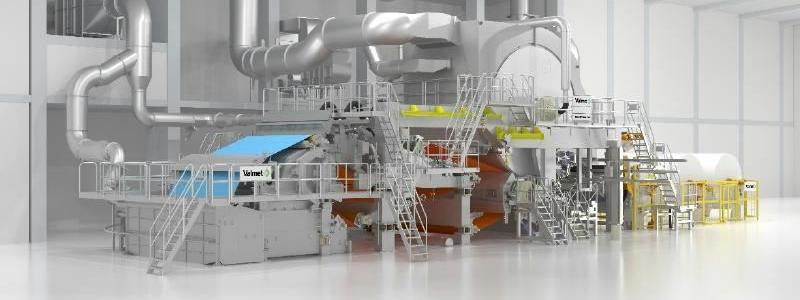

Changes are well underway as the standardisation of crescent former configurations and sizes have allowed machines to be built in auto assembly line fashion in workshops at much lower costs than the traditional engineered custom machines. Steel Yankee assembly is rapidly joining this disruptive approach to machinery sourcing.

“Product focus is moving toward a two level strategy with economy and premium performance products.” states Bruce W. Janda, author of the report.

“Middle of the road products will increasingly be left behind.”

Recycled fibre for tissue making will see shortages as tissue demand grows and the supply of recyclable papers decreases in the electronic media conversion. This will have a disruptive effect, particularly in North America over the period to 2021. Tree-free tissue products are poised to take off in North America and this period will show if consumers will respond with interest. Sustainable pulping where fibre is a by-product of non-fossil energy or feedstock production is moving forward in Northern Europe.

Tissue manufacturing is growing in all regions, albeit at distinctly different rates. The two undeveloped tissue markets remain Africa (excluding South Africa) and India. These are unlikely to change the market balance in the next five years. Improved hot air hand dryers will continue to take business away from paper hand towels with substitution rates above 30% expected in Western Europe and North America by the end of this period.

The operating environment for tissue manufacturers will increasingly be constrained by uncertain water and energy access and costs. Sustainability measures will become a greater factor as consumer and government requirements increase. The growth of non-wood fibre sources has opened up new possibilities for simplified and sustainable pulping processes. New approaches to dry strength additives show potential to increase tissue softness and productivity. Enzyme applications for fibre modification and process management will offer potential sustainable improvements to tissue manufacturing.