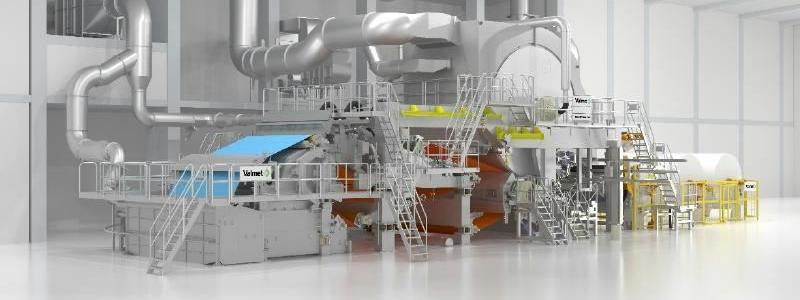

Europe’s manufacturing sector is in crisis, with production levels plummeting by up to 40% in 2025 compared to 2018, resulting in the loss of approximately 200,000 jobs last year. Amid this downturn, the pulp and paper industry has emerged despite its own difficulties as a relative stronghold, underscoring the urgent need for sustainable solutions to support Europe’s competitiveness.

A Deloitte report unveiled ahead of an informal summit of EU Heads of State in Alden-Biesen on 12 February, to discuss fixes to the EU’s declining competitiveness, highlights biomass utilisation and material circularity as pivotal factors enhancing Europe’s industrial competitiveness. But without immediate action, Europe risks losing its leadership in the bioeconomy sector.

EU legislation still hinders competitiveness and development related to biomass. The forest sector, governed by national legislations and schemes, faces additionally over 100 EU regulations, complicating its growth. Circularity, and notably collection of paper for recycling is still very fragmented across Europe. This regulatory complexity raises critical questions about Europe’s commitment to prioritising its driving forces for change.

European industries operate under the world’s highest standards in sustainability, carbon footprint, labour conditions, and innovation. However, these high environmental and climate standards are insufficiently reflected in market demand, leading to an uneven playing field with fossil-based products and materials often sourced from outside of Europe. The introduction of carefully designed local content and European preference is supported by the industry as a tool for resilience in critical value chains and Europe’s strategic autonomy.

The Deloitte report also underlines the shortfalls and complexity of the public instruments which fund innovative industrial decarbonisation projects. One source of the issue is that revenues from the EU Emission Trading Scheme (ETS) are not redistributed well enough. The size of the funding which could potentially be generated by Member States could be a ‘game changer’ for the industry’s capacity to reach stringent decarbonisation objectives by 2030.

Quotes from Jori Ringman, Cepi Director General:

“The European pulp and paper industry has already reduced its greenhouse gas emissions by more than 50% compared to 2005 levels.”

“But in the current context of high energy prices, low demand, high costs and an ongoing trade war, we have no choice but to ask the EU Heads of State assembled in Alden-Biesen to maintain free allocation levels and the eligible pulp and paper installations list of the 2021-2025 period and freeze any measures increasing carbon costs until 2030.”