Rayonier and PotlatchDeltic announced that they have entered into a definitive agreement to combine in an all-stock merger of equals, creating a leading domestic land resources owner and top-tier lumber manufacturer.

The combined company will become the second-largest in the sector.

Based on the closing stock prices of Rayonier and PotlatchDeltic on October 10, 2025, the last business day prior to the execution of the agreement, the combined company is expected to have a pro forma equity market capitalization of $7.1 billion and a total enterprise value of $8.2 billion, including $1.1 billion of net debt.

Upon completion of the transaction, the combined company will become the second-largest publicly traded timber and wood products company in North America and will be well-positioned to capitalize on an improving housing market as well as opportunities in higher-and-better-use (HBU) real estate and land-based / natural climate solutions.

Under the terms of the agreement, which has been unanimously approved by the Boards of Directors of both companies, PotlatchDeltic shareholders will receive 1.7339 common shares of Rayonier for each share of common stock of PotlatchDeltic.

The exchange ratio represents an implied price of $44.11 per PotlatchDeltic share, and a premium of 8.25% to PotlatchDeltic’s closing stock price on October 10, 2025 (the last business day prior to execution of the agreement). Upon closing of the transaction, Rayonier shareholders will own approximately 54% and PotlatchDeltic shareholders will own approximately 46% of the combined company.

The combined company will operate under a new name, to be announced prior to closing.

The combination will bring together two leading land resources companies, leveraging significant timberland and real estate expertise as well as operational excellence in lumber manufacturing. Together, the combined company will have a productive and diverse timberland portfolio comprising approximately 4.2 million acres, including 3.2 million acres in the U.S. South and 931,000 acres in the U.S. Northwest.

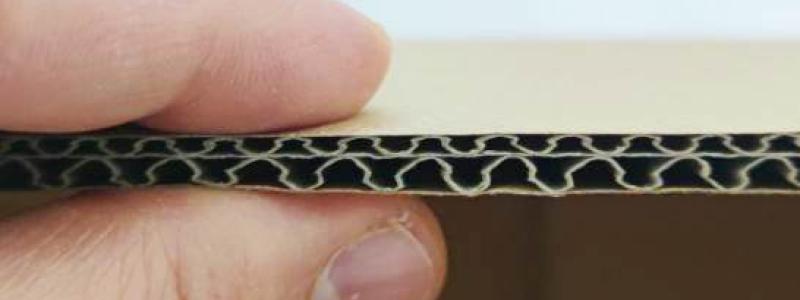

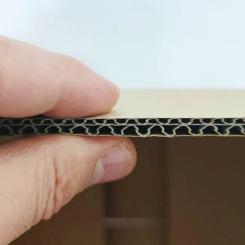

In addition, the company will operate seven wood products manufacturing facilities, including six lumber mills with total capacity of 1.2 billion board feet and one industrial plywood mill.

Mark McHugh, President and Chief Executive Officer of Rayonier, said, “We are excited to announce this strategic merger of equals, combining two exceptional land resources companies to deliver enhanced value for our shareholders and other stakeholders. Rayonier and PotlatchDeltic share a commitment to sustainability and a legacy of excellence in delivering land resources to their highest and best use. We look forward to completing the transaction, and we are confident that the merger will generate meaningful value creation.”

Eric Cremers, President and Chief Executive Officer of PotlatchDeltic, said, “This merger is a watershed moment for both companies. Our complementary assets and shared vision will unlock opportunities to create significant strategic and financial benefits beyond what could be achieved by either company independently. We look forward to working together to ensure a seamless transition and to capitalize on exciting opportunities for optimization and growth.”