Global trade of softwood logs in 2019 remained practically unchanged from 2018 at 93 million m3, reported Wood Resource International. As much as 45% of globally shipped logs were destined for China. Sawlog prices continued their decline on all continents in late 2019. By far the biggest price reductions in 2019 occurred in Europe, particularly in the central region of the continent. In the 4Q 2019, the GSPI sawlog price index dropped for the seventh consecutive quarter to its lowest level since early 2016.

Global Pulpwood Markets

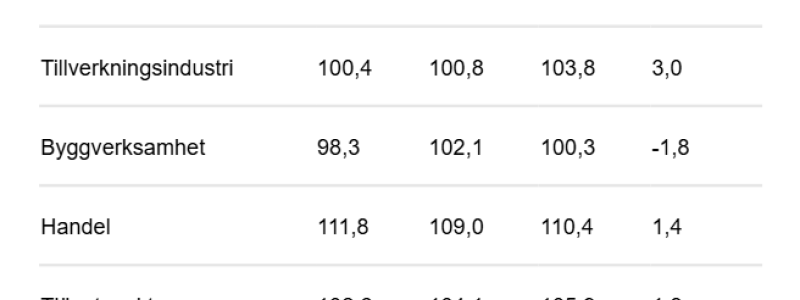

Wood fiber costs for the world’s pulp mills continued to decline in the 4Q 2019. The biggest price reductions of wood chips and pulpwood occurred in Europe and Latin America, while the downward price movements in Asia, Oceania and North America were more modest q-o-q.

Both WRI’s wood fiber price indices declined for the third consecutive quarter in the 4Q 2019. In the 4Q 2019, the Softwood Fiber Price Index (SFPI) fell 2.0% q-o-q, the lowest level in 2.5 years. The Hardwood Fiber Price Index (HFPI) was 3.0% lower than the previous quarter and the lowest it has been since the 2Q/17.

Global Pulp Markets

In 2019, global shipments of chemical pulp were up 3.5% from the previous year. This increase was mostly the result of a strong second half of the year when pulp imports to China were up 16% from the 2H 2018. The NSBK price in Europe finally stopped falling in late 2019 to reach a three-year low of $820/ton in December, while the BHKP prices levelled off at $680/ton.

Global Lumber Markets

Profits for sawmills in the US South reached record highs in 2018 but have since fallen substantially and were below their ten-year average in the 4Q 2019, according to the Wood Resource Quarterly. 2019 was the year when Russia surpassed Canada as the world’s largest exporter of softwood lumber.

The shift at the top came as the result of declining exports from Canada, particularly from British Columbia to the US, and a substantial increase in exports from Russia to China. Overseas lumber supply to the US increased to a record 14% of total imports in the 4Q 2019, with Germany, Sweden, Chile, Brazil and Austria being the largest suppliers. China continued to increase importation of softwood lumber in 2019 when 28 million m3 was unloaded at the country’s ports, 15% more than in 2018.

Global Biomass Markets

Global trade of wood pellets reached a record high in 2019 with almost half of the volume being destined for the United Kingdom and Denmark. Import prices for wood pellets moved up in the 4Q 2019 for all the major importing countries in Europe. The biggest change was seen in Belgium, where pellet prices jumped 14% q-o-q.

Source: Lesprom Network