Fortress Paper Ltd. reported 2011 first quarter EBITDA of $1.0 million on sales of $85.5 million. For the fourth quarter of 2010 EBITDA was $3.6 million on sales of $83.5 million and for the three

months ended March 31, 2010 EBITDA was $5.1 million on sales of $50.3 million.

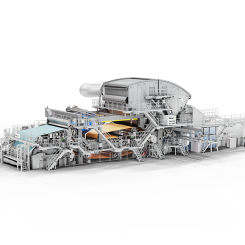

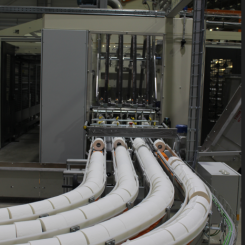

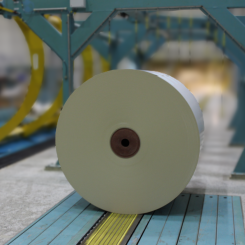

At Landqart, the Company completed the successful transformation of PM1 to a high security paper-machine and began production of bank note papers on the new machine. The rebuilt PM1 allows the Company to consolidate bank note and high security papers production on PM1 and significantly improve overall production efficiency. By consolidating production of bank note and security papers into PM1, the Landqart mill has temporarily suspended the commercial operation of paper machine number 2 and will utilize it only for trials and sample production until such time as this additional capacity is required. The plan to improve our production efficiency has resulted in a reduction of our overall labour requirements. The full impact of the plan to improve overall efficiency will be realized in the fourth quarter of 2011. With escalating raw material costs in cotton and over capacity due to the postponement of implementation of several major currencies, 2011 will be a challenging year for Landqart and the banknote industry. The results at Fortress Specialty Cellulose reflect weakening NBHK prices that have come off their peaks reached in 2010 and a strengthening Canadian dollar. The shut-down of the mill for conversion to dissolving pulp is scheduled for late third quarter 2011. The underlying markets for dissolving pulp remain strong which continues to provide management with conviction in our attempts to expand further in this business segment.

In the first quarter of 2011, Fortress completed the acquisition of the assets of the Bank of Canada's Optical Security Material which produces the optically variable material for the security threads contained in various banknotes, including application in the Canadian banknotes. The Company paid a purchase price of $0.75 million for the OSM assets and granted the Bank of Canada a royalty-free license to use the intellectual property sold to the Company for Canadian banknote applications.

In February of 2011, Fortress completed a public offering of 967,000 common shares of the Company and the underwriters exercised their over-allotment option and purchased an additional 145,050 common shares at a price of $51.75 per share, resulting in aggregate gross proceeds under the offering of $57.5 million. Proceeds of the offering are being used to finance certain capital expenditures relating to its Fortress Specialty Cellulose Mill in Thurso, Quebec and the construction of a high security facility adjacent to the Fortress Specialty Cellulose Mill which will house the Company's OSM Assets recently acquired from the Bank of Canada, and for working capital and general corporate purposes.

The remaining $7 million principal amount of the Company’s $15 million unsecured convertible debenture that was issued on April 30, 2010 has been converted. The Company has issued 350,000 common shares with this redemption.