Fibria, a Brazilian forestry company and the world’s largest eucalyptus pulp producer, has already structured all of the financing for the Horizonte 2 Project, which will expand production capacity at its Três Lagoas Unit located in the state of Mato Grosso do Sul. Total investment was revised to R$ 8.7 billion, or approximately US$ 2.2 billion, down from the initial capital expenditure of US$ 2.5 billion.

According to Fibria’s Chief Financial and Investor Relations Officer, Guilherme Cavalcanti, the combination of financing and own capital allowed the company to reach an average cost of 2% p.a. in U.S. dollar. The project’s financial solution will improve the company’s credit quality by reducing the average interest rate from 3.3% to 2.8% and lengthening repayment terms.

Around 30% of total financing, or R$ 2.6 billion, will come from cash generated by Fibria, which has been consistently posting record-high operating results.

The Brazilian Development Bank (BNDES) could provide R$ 1.7 billion in financing if the project, which is currently in the analysis phase, is approved, which would represent 20% of the project’s total financing. For this funding, Fibria qualified for the Fixed Income Market Incentive Program of the BNDES and the Brazilian Financial and Capital Markets Association (Anbima) and has already issued Agribusiness Receivables Certificates (CRA), which would give Fibria access to a larger portion of the BNDES facility at the Long Term Interest Rate (TJLP). Marking the first time they are being issued by Fibria, the CRAs enjoyed strong demand and helped stimulate Brazilian capital markets, with a record 34 brokerages distributing the securities. The issue amounted to R$675 million, with a rate corresponding to 99% of the CDI.

Fibria also received approval for a R$ 1 billion financing facility through a project of the Midwest Development Superintendence (SUDECO) and the Midwest Development Fund (FDCO). Fibria received approval in October and the transaction should be completed by year-end.

In the international market, Fibria gained access to two financing facilities: a US$ 400 million Export Prepayment Facility Agreement with an average cost of Libor + 1.43% and average term of 5 years; and a US$ 300 million facility from the Finnish export credit agency Finnvera (Finland), which finances equipment acquisitions in the country.

“Since it holds investment grade credit ratings at the main rating agencies, when structuring the financing for the Horizonte 2 Project, Fibria was able to gain access to the best opportunities in the market with financing facilities adequate for its cash flow profile from the world’s best international credit institutions,” said Marcelo Habibe, Treasury general manager.

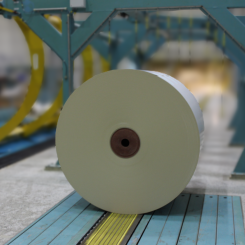

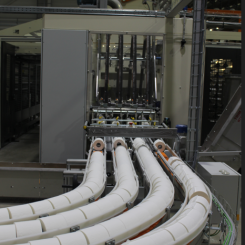

Construction on the Horizonte 2 Project has already begun and is advancing on schedule. On Oct. 30, the cornerstone ceremony was held, with the project’s commissioning expected by end-2017.

Fibria’s new pulp production line in Três Lagoas, Mato Grosso do Sul will create 40,000 jobs during construction. Once the project is completed, 3,000 direct and indirect jobs will be created.