The main theme for the conference PulpPaper 2014, “Biofuture for Mankind”, seems quite forward-looking. Just one month before the inauguration of the conference, the European Council announced the launch of a €3.7 billion project called The Bio-Based Industries Joint Undertaking (BBI), with a similar approach to the bio-economy of tomorrow. The BBI is dedicated to realizing the European bio-economy potential, by turning biological residues and wastes into greener everyday products. Almost simultaneously, Metsä Group announced its plans to build a bio-products mill. The investment of EUR 1.1 billion would be the largest-ever investment in the forest industry in Finland.

How can we be sure that the utilization of the forest biomass contributes the most to our economy and societies? This question is closely tied to another one: how can we guarantee a sustainable and responsible utilization of forest land? These questions are not only about economics - profitable and sustainable growth - but of course also a matter of what is ecologically wise. Subsequently, decision-makers have to consider a large and increasing number of highly complex matters, which makes decision-making time-consuming.

On the other hand, the ailing paper industry(ies) requires proactive and urgent initiatives to avoid worst-case scenarios, i.e. mill closures or companies going bankrupt, that is threatening the pulp and paper industry.

Precious assets

Faced with a declining demand for many of its products, forest companies, regions and even whole countries, provided with a lot of forest land, have to ask them themselves what they should do with their precious assets. From a national economic point of view, these assets are indeed precious, since they consist of exports with low import “content”. Some analysts (Danske Bank) hold that it was the forestry industry that saved Sweden from the financial crisis, just because of its high “net export” rate. In comparison, car or computer manufacturers need more imports of parts provided from other countries for the assembly of their products, and this “imported export ratio” decreases these products’ “net export” value. But can a country depending to a large extent on exports from its forest industry rely on this in the future? Nothing is less certain.

Future side-streams of the forest biomass

Future industrial side-streams of the forest biomass, enabled by the recent advances in nanotechnology, such as medical devices, sensors and displays will eventually become integral parts of new manufacturing supply chains, and will not be shipped in large vessels or containers - the production will anyway not be counted in millions of tonnes. The side-streams from a more diversified forest industry will most certainly be less voluminous. Whatever these side-streams might be the analysis of their economic impact on a nation’s economy will become more complex than it is today.

The future of the forest industries not only concerns forest covered countries; the European Union has now realized that Europe needs a continent wide policy to increase its competiveness for its forest industries.

The Bio-Based Industries Joint Undertaking

The European Council approved, on 6 May, a Public-Private Partnership (PPP) between the EU and the Bio-based Industries Consortium (BIC) called The Bio-Based Industries Joint Undertaking (BBI). The aim is to will develop new and competitive bio-based value chains that replace the need for fossil fuels and have a strong impact on rural development.

The focus remains on bio-refineries, which are said to be at the heart of the bioeconomy.

EU hopes that the BBI will create new jobs, especially in rural regions, and offer Europeans new and sustainable products sourced and produced locally. It will help to make the economy more sustainable by using renewable resources in a smart and efficient manner. Another objective of the BBI is to increase the competitiveness of the European economy through re-industrialisation, by creating new value chains will be created between often unconnected sectors, ranging from primary production and processing industries to consumer brands.

A multi-billion euro initiative

The BBI might enable European companies to become more competitive in the so called “bio-economy race” with US, China and Brazil.

Another important aspect is that the BBI is expected to bridge European research knowledge with commercial scale bio-based products, making full use of European scientific and technological knowledge.

The multi-billion euro initiative will fund projects focusing on:

- Building new value chains based on the development of sustainable biomass collection and supply systems with increased productivity and improved utilisation of biomass feedstock;

- Unlocking the utilisation and valorisation of waste and lignocellulosic biomass;

- Bringing existing value chains to new levels, through optimised uses of feedstock and industrial side-streams while offering innovative added value products to the market, thus creating a market pull and reinforcing the competitiveness of EU agriculture and forest based industries.

- Bringing technology to maturity through research and innovation, by upgrading and building demonstration and flagship biorefineries that will process the biomass into a range of innovative bio-based products.

The BBI’s first Call for Proposals will be launched on 9 July 2014.

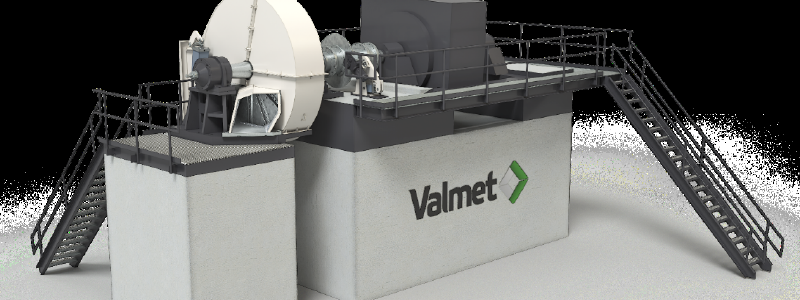

New bio-product plant

Similarly, the Finnish company Metsä Group recently announced a multi-billion investment plan for a new bio-product plant, built adjacent to its Äänekoski mill. According to Metsä Group, the EUR 1.1 billion investment would be the largest-ever investment in the forest industry in Finland. Although Metsä Group meticulously avoid the term “biorefinery”, which is far more common than “bio-product mill”, it seems that similar range of products are in focus, namely “high-quality pulp, bio-energy and various bio-materials in a resource-efficient way”.

Impacts of the investment

The annual impact of the investment on the Finnish economy is expected to be over EUR 0,5 billion and it might create 2500 jobs in the forest industry. The annual increase in the value of exports is estimated to be EUR 0.5 billion. Kari Jordan, president and CEO of Metsä Group, said in a press release:

- Our new mill will be the most efficient and modern bio-product mill in the world. The global increase in the demand for high-quality softwood pulp is the most important driver for the investment, and our aim is to strengthen our leading position in this market. The investment will support Metsä Fibres’ growth and improve profitability in the long term.

The impact of the investment is far-reaching. The company anticipates that the bio-product mill will even contribute to achieving Finland’s renewable energy targets. It will not use any fossil-based fuels for its own processes; all of the energy needed will be generated from wood.

Final decision

When the mill is up and running, the consumption of fibre wood in Finland is expected to grow by 4 million cubic metres (some 10 per cent) per year. The harvesting capacity of softwood can increase sustainably by 7 million cubic metre in Finland, without putting the environment in danger, according to Metsä Group. The majority of the wood fibre will be sourced in Finland.

The final investment decision is scheduled to be made in the first quarter in 2015, in which case the bio-product mill would be operational during 2017.