Neenah Paper, Inc. recently reported earnings from continuing operations of $0.68 per diluted common share in the third quarter of 2013 compared with earnings of $0.55 per share in the third quarter of 2012. After excluding net impacts of a research and development tax credit in 2013 and other unusual costs in both years, adjusted earnings in the third quarter of 2013 were $0.61 per diluted common share and compared to adjusted earnings of $0.56 per share in the third quarter of 2012. Adjusted earnings are reconciled to comparable GAAP figures later in this release.

Net sales of $214.1 million in the third quarter of 2013 increased four percent compared with the third quarter of 2012. Operating income of $16.4 million was also ahead of the prior year period as mid-single digit growth in Fine Paper and Technical Products was partly offset by higher unallocated corporate expense. Net income of $11.4 million in 2013 grew from $9.1 million in the prior year as a result of higher operating income, lower interest expense and reduced tax expense after including the tax credit.

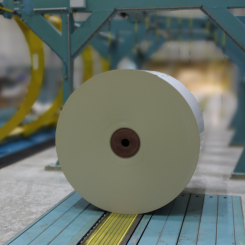

"Both of our business segments performed well in the quarter, with each delivering solid top line growth and an improved bottom line. Technical Products expanded globally behind strong filtration and specialty tape growth, while Fine Paper continued to generate attractive returns through a more efficient operating platform and a higher value mix of products,” said John O’Donnell, Chief Executive Officer.

“Cash flow from operations was an impressive $35 million, anchored by strong business earnings and supplemented by improvements in working capital. Our cash generation and strong balance sheet are providing the financial flexibility to deliver on our commitment to increase cash returns to shareholders while pursuing value-adding growth investments in performance-oriented technical products.”