Neenah Paper recently reported 2016 third quarter results. Revenues of $232.9 million increased 1 percent, led by growth in Technical Products. Operating income grew 10 percent to $26.9 million as margins expanded due to lower costs and increased sales.

Earnings per diluted common share from continuing operations of $0.95 increased 22 percent compared with $0.78 per share in 2015. Excluding 2016 and 2015 integration and restructuring costs of $0.04 per share and $0.11 per share, respectively, adjusted E.P.S. of $0.99 in 2016 increased 11 percent compared with $0.89 per share in 2015.

Cash generated from operations of $40.6 million increased from $35.0 million in 2015.

"Adjusted earnings" is a non-GAAP measure used to improve understanding and comparability of year-on-year results.

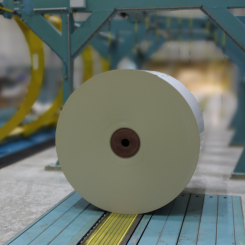

"While global economic growth remains subdued, our teams continue to serve our customers and manage costs to deliver the consistent bottom line results our shareholders have come to expect," said John O'Donnell, Chief Executive Officer. "In addition, we are completing key initiatives that will drive significant long-term value. Our strong quarterly cash flows have helped fund high-returning organic initiatives like the addition of new transportation filtration capacity in the U.S., increased cash returns to shareholders, and a strong balance sheet to enable future strategic investments."