Rayonier Advanced Materials recently reported full year net income of $55 million, or $1.30 diluted earnings per share. Full year pro forma net income was $73 million or $1.74 per share, compared to $106 million, or $2.51 per share, in 2014.

For the fourth quarter 2015, the Company reported net income of $13 million, or $0.30 diluted earnings per share. Fourth quarter pro forma net income was $14 million, or $0.32 per share, compared to $26 million or $0.61 per share for the prior year period.

“Our focused effort to improve costs coupled with favorable raw material prices led to solid results that exceeded our 2015 guidance,” said Paul Boynton, Chairman, President and Chief Executive Officer. “During our first full year as a public company, we achieved many important milestones including the successful implementation of our $40 million cost savings initiative and free cash flow generation of $124 million, the entry into key customer contracts extending through 2019, the reinvigoration of our innovation platform and the repositioning of our manufacturing assets to better align us with market conditions.”

For the full year 2015, net sales were $941 million, a decline of $17 million, or 2 percent, from $958 million for the full year 2014. Fourth quarter 2015 net sales were $242 million, a decline of $6 million, or 2 percent, from $248 million in the prior year comparable quarter.

The sales decrease was driven primarily by lower cellulose specialties prices. Additionally, cellulose specialties volumes declined approximately 12 thousand tons, or 2 percent, as we worked with our customers during the fourth quarter to assist them in balancing their inventories to address lower demand as a result of acetate supply chain de-stocking. Partially offsetting the decline were higher commodity sales volumes, driven by improved operational run rates and reduced inventory levels.

Full year 2015 pro forma operating income was $149 million compared to $181 million for 2014. The decrease was largely due to lower cellulose specialties sales prices and volumes. Higher selling, general and administrative expenses, primarily associated with being a stand-alone public company, also contributed to the decline. The decreases were partially offset by lower costs as a result of cost reduction initiatives and benefits from lower raw material input costs as well as higher commodity sales volumes.

For the fourth quarter of 2015, pro forma operating income was $30 million, $17 million below fourth quarter 2014 pro forma results of $47 million. The decrease was largely due to lower cellulose specialties sales prices and volumes along with higher environmental expenses.

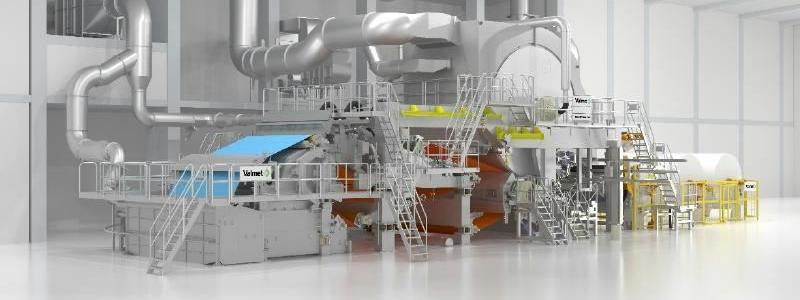

Italian tissue manufacturer Industrie Cartarie Tronchetti (ICT) announces the start-up of its first tissue paper...

Energy-intensive industries (EIIs), including CEPI, has published a joint statement on the energy and carbon...

Suzano, the world’s largest pulp producer, announces its results for both the final quarter (4Q25)...

Fibre Excellence is facing severe financing problems in France. According to Euwid, the company may...

Coveris, one of the major European flexible plastic and paper packaging manufacturers, have announced the...

Tetra Pak has taken another step forwards in sustainable packaging by expanding its innovative paper‑based...

Finnish paperboard producer Metsä Board has decided to suspend its planned production conversion at the...

Questar Solutions, a leading distributor of industrial and UN-certified performance packaging, today announced two significant...

Nippon Paper Resources Australia, a wholly owned subsidiary of Nippon Paper Industries Co., Ltd., has...

Job listings