UPM-Kymmene posts weaker profitability in 2025 due to lower sales prices and adverse currency effects outweigh higher pulp deliveries, stable energy production, and capacity reductions in communication papers.

In 2025, sales fell 7% to Euro 9.66 billion, while comparable EBIT decreased 25% to Euro 921 million, based on figures released by UPM.

The company says that sales prices decrease across all business areas, with the strongest pressure recorded in pulp, communication papers, and specialty papers. Currency movements further reduce earnings, while changes in delivery volumes have a neutral impact at group level.

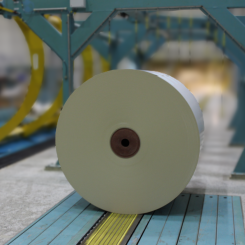

Pulp operations record higher delivery volumes despite weaker pricing. Total pulp deliveries increase 4% to 5.16 million tonnes, supported by stable operations in Fibres South. Average pulp prices decline 15%, while high wood costs in Finland weigh on Fibres North results. Maintenance shutdowns take place at Paso de los Toros, Kymi, Kaukas, and Fray Bentos mills during the year.

Weak demand in graphic paper markets continues to reduce output. Communication paper deliveries decline 11% to 2.89 million tonnes, while paper production stops at the Kaukas mill in Finland and Ettringen mill in Germany. These closures reduce communication paper production capacity by 13%, according to the company.

Specialty Papers records lower deliveries but improved profitability. Paper deliveries decline 2% to 1.40 million tonnes, while comparable EBIT increases 9% to Euro 147 million, driven mainly by lower depreciation and reduced input costs.

Adhesive Materials delivery volumes increase faster than underlying markets, although the company does not disclose absolute production figures. Production is discontinued at the Nancy site in France, while ramp-down continues at the Kaltenkirchen facility in Germany.

Massimo Reynaudo, President and CEO, comments on the results:

“Year 2025 was characterized by escalating geopolitical and trade tensions, which had an adverse effect on our business environment. Amidst the trade uncertainties and weakening consumer confidence, we intensified actions to both sharpen our competitiveness and to execute our portfolio strategy. This resulted in a visible improvement of performance in most businesses and a very strong cash flow in the fourth quarter.

We launched significant strategic initiatives that continue to transform the company. In February, we acquired Metamark in Adhesive Materials. In May, we refocused our biofuels growth strategy and discontinued the biorefinery development in Rotterdam. In September, we started the strategic review of our Plywood business. In December, we announced the plan to establish a graphic paper joint venture that would encompass the UPM Communication Papers business and Sappi's graphic paper operations in Europe.

By these portfolio initiatives, we aim to change the profile of the company, increasing its growth focus and improving the margins and leverage. Future UPM would have an attractive portfolio focused on renewable fibres, advanced materials and decarbonization solutions. All these businesses operate in growing markets. Across these businesses UPM has shown a strong track record of realized growth above GDP.

Energy operations record slightly lower electricity output. Total electricity deliveries decline 2% to 11,141 GWh, while the average electricity sales price falls 2% year on year. Higher production costs offset seasonal volume gains late in the year, resulting in lower full-year earnings.

UPM reports a major operational milestone at the Leuna biorefinery, where commercial operations begin during 2025. First customer deliveries of industrial sugars take place in the fourth quarter, marking the transition from construction to commercial production.

Operating cash flow increases 4% to Euro 1.41 billion, supported by a Euro 391 million reduction in working capital. Net debt rises 5% to Euro 3.00 billion, while the net debt to EBITDA ratio increases to 2.29.

UPM also confirms a proposed graphic paper joint venture with Sappi, valued at Euro 1.42 billion, which would combine the parties’ European graphic paper operations and reduce UPM’s direct exposure to declining graphic paper markets.

For 2026, UPM states that its comparable EBIT in the first half of the year is expected to be in the range of Euro 325 million to Euro 525 million. The company expects performance in the first half to benefit from moderately higher sales prices and delivery volumes and lower fixed costs compared with the second half of 2025, while continued weakness in communication paper markets and increased costs during the early phase of the Leuna biorefinery ramp-up are expected to weigh on results.